Chartbook : 2025 in review

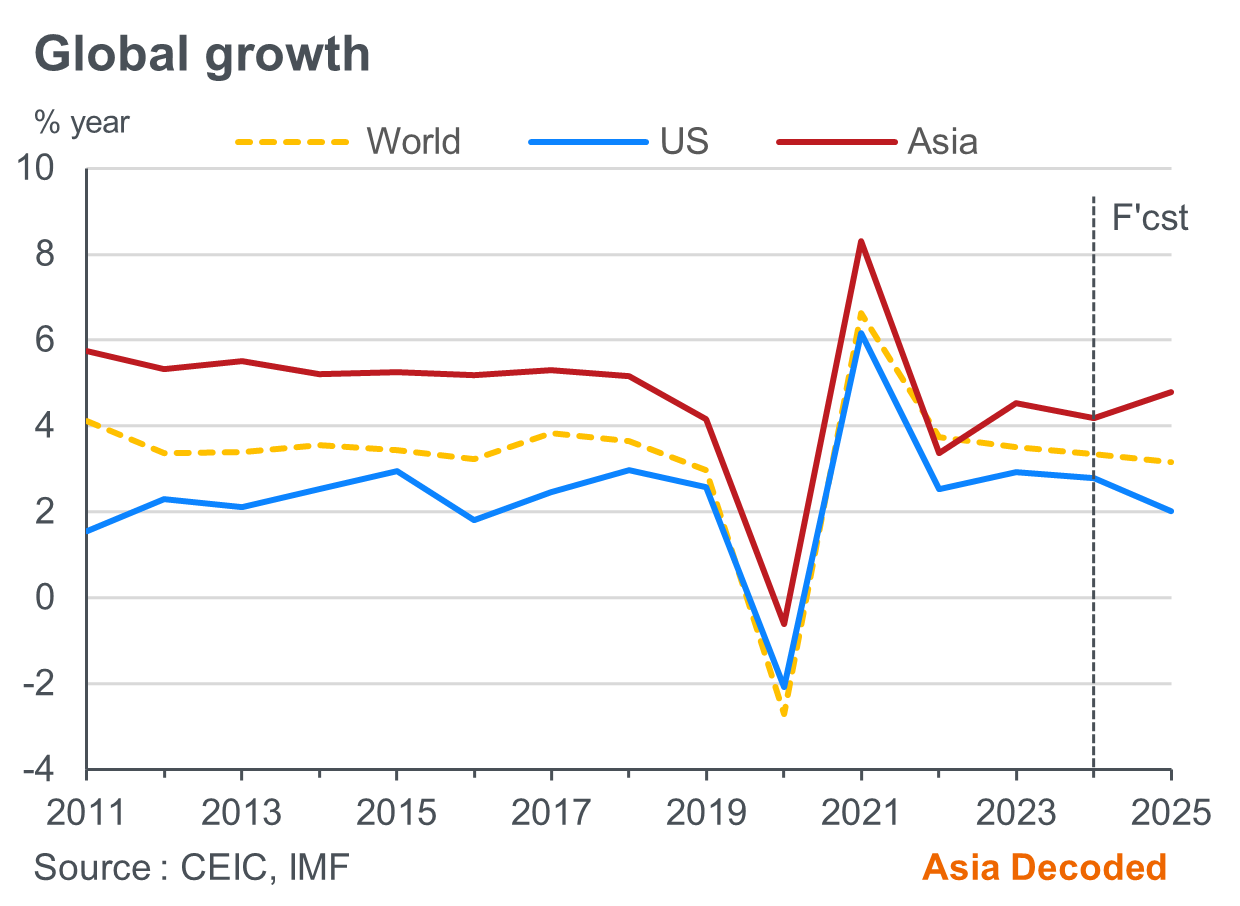

Asia defied US tariffs to grow at a faster pace in 2025 than 2024. But the tech-led growth spurt masks internal fault lines of sluggish domestic demand and a weakening manufacturing sector.

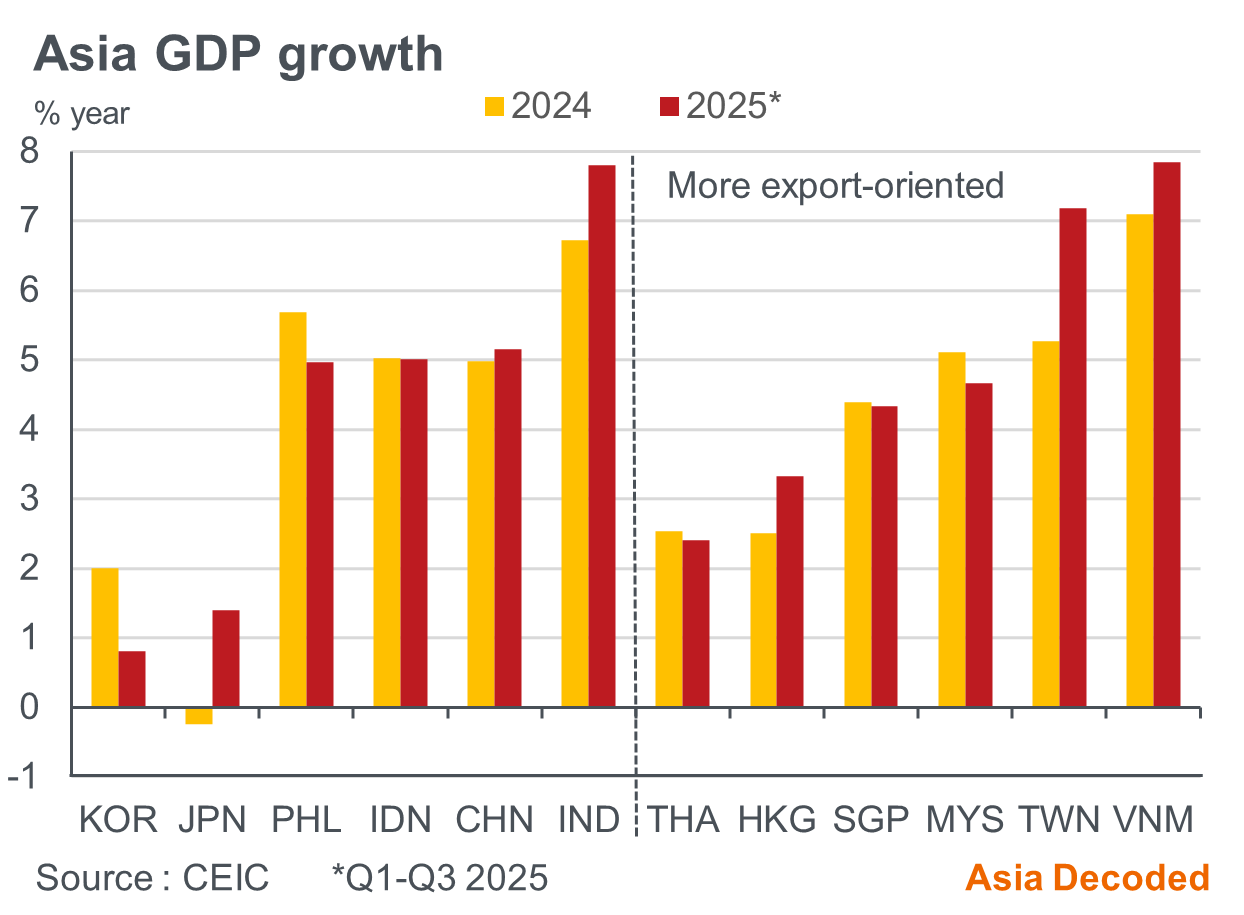

Contrary to our and consensus expectations, Asia’s growth engine remained resilient in 2025. Aggregate real GDP growth across the 12 major Asian economies - Japan, S Korea, China, Hong Kong, Taiwan, India, Indonesia, Thailand, Malaysia, Singapore, Philippines and Vietnam - likely rose to 4.6% in 2025 from 4.2% in 2024. Notably, the export-oriented economies of Hong Kong, Singapore, Vietnam, Malaysia, Taiwan, and Thailand grew at a similar or faster pace in the first three quarters of 2025 than 2024, despite the US implementing a record increase in tariffs.

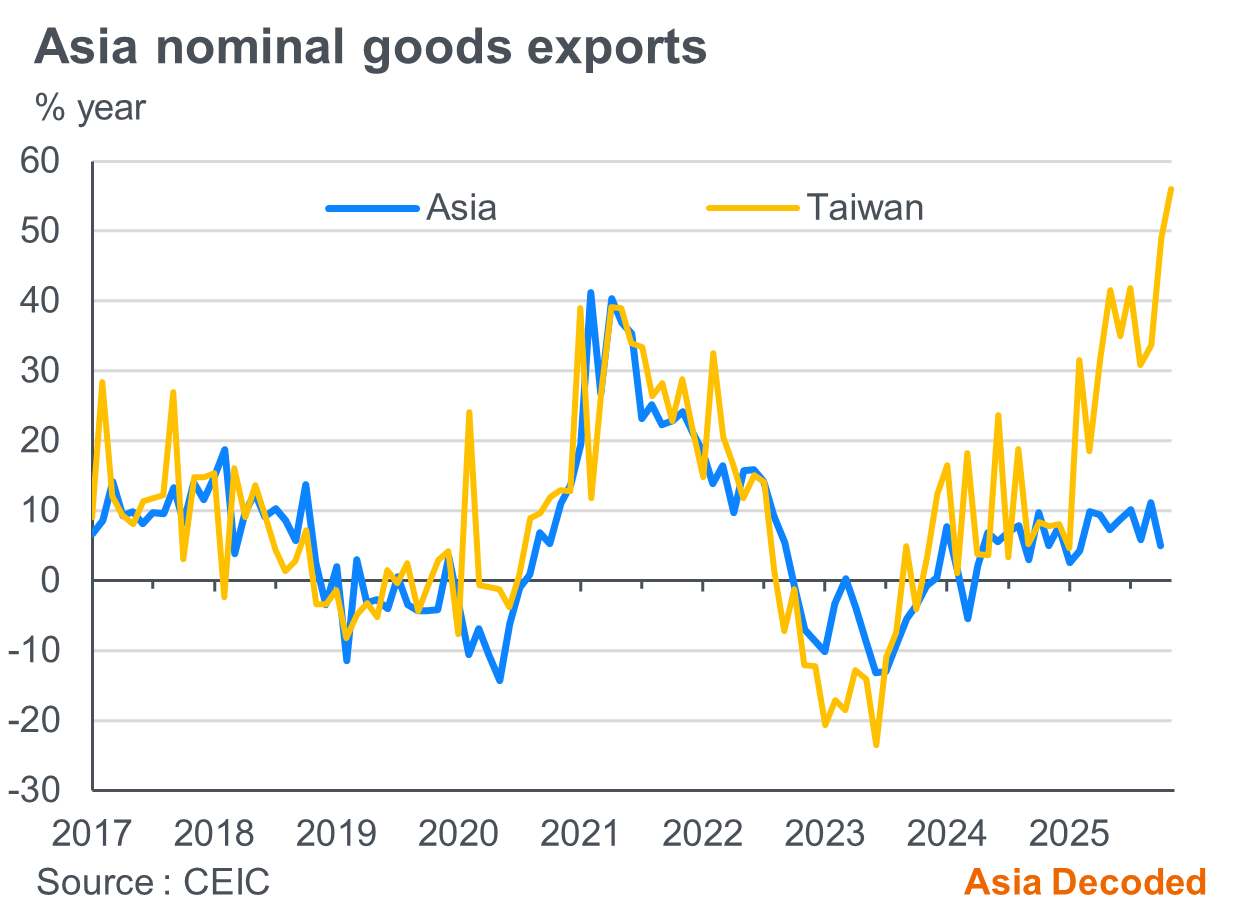

Growth was largely driven by strong exports. Merchandise exports grew 7.5% y/y in Jan-Oct 2025, led by double-digit growth in Taiwan, Vietnam, Malaysia, Thailand and Philippines. This compared with full year growth of 10.2% in 2024.

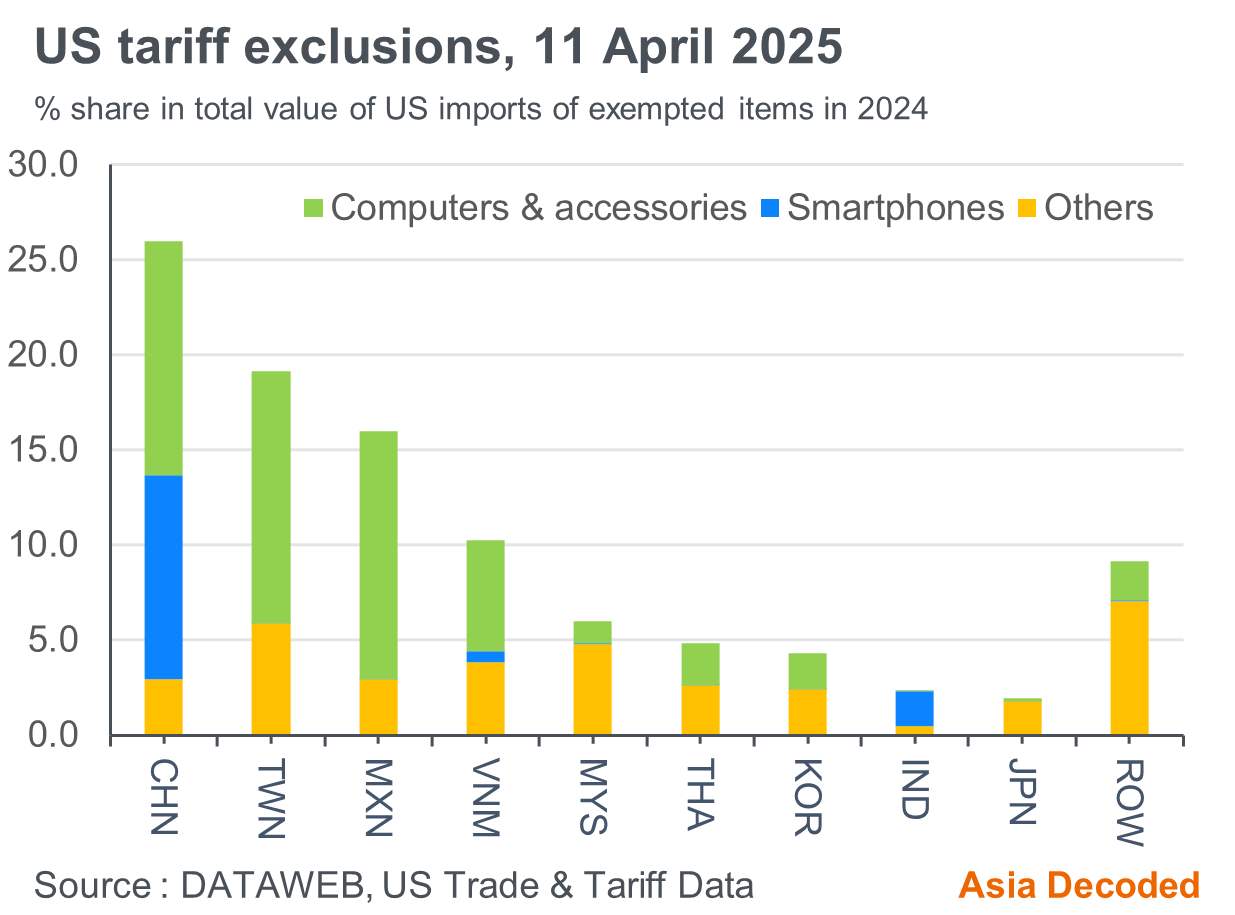

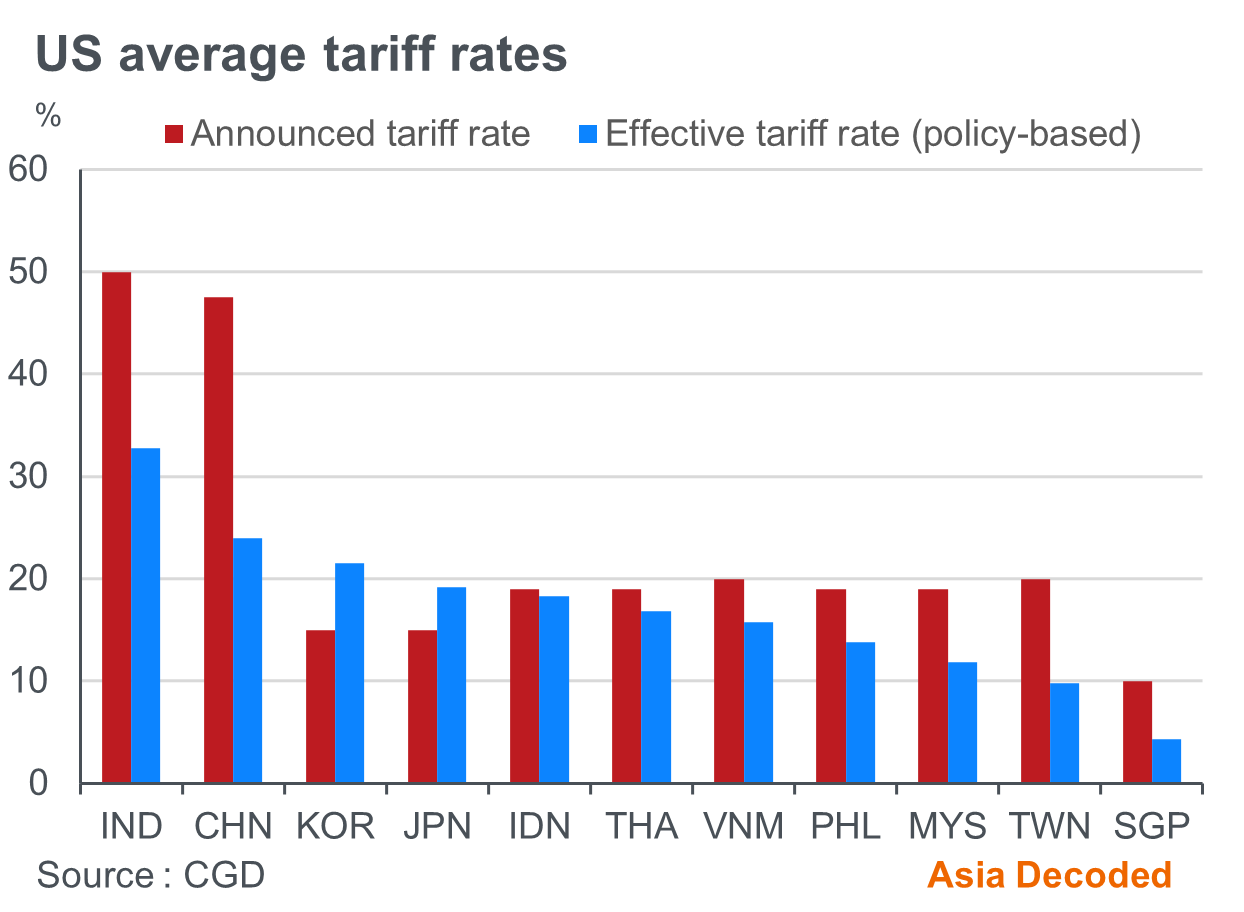

This was partly due to tariff front-running by US firms at the start of the year and smaller drag from tariffs than initially expected. Not only did the majority of US tariff hikes did not take effect until the second half of the year, but also exemptions on key commodities like electronics and pharmaceuticals kept the effective tariff rates well below the announced ones for many Asian economies.

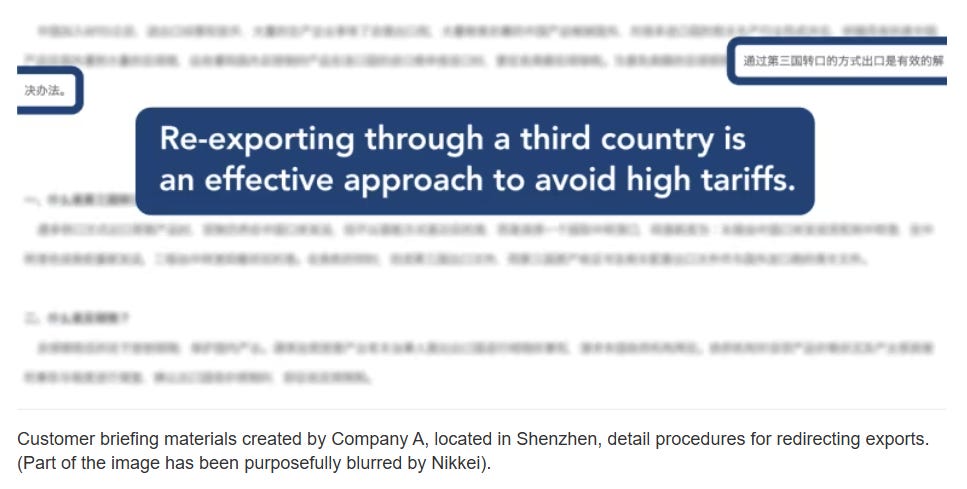

However, these factors alone do not explain the resilience of Asian exports. A key debate in 2025 was whether Asia’s export strength was mainly due to rerouting of Chinese goods to the US through other countries, primarily in Southeast Asia (SEA).

It is difficult to refute this claim, given the simultaneous jump in SEA’s imports from China and exports to the US. Nikkei Asia’s year-end investigative piece on Vietnam’s role as a connector economy provides compelling evidence of the country’s role in helping Chinese firms circumvent high US tariffs.

A Nikkei investigation has found that multiple Chinese trading companies propose to their clients that they can avoid the U.S.’s high tariffs by first sending their U.S.-bound exports to Vietnam.

But the quantum of such transshipments is difficult to gauge, as goods may travel through more than one country before reaching the US. A Harvard study found that only around 9% of the increase in Vietnam’s exports to the US over 2018-21 was due to rerouting of Chinese goods. 2025 headline data are consistent with this assessment. Exports from China and the rest of the region continued to rise through the year even as US import demand reset lower after Q1.