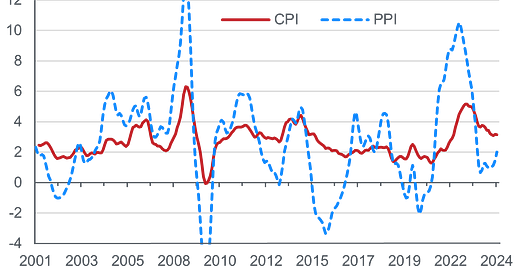

Asia's PPI has turned a corner

This poses another hurdle to the region's last mile of consumer disinflation and rate cut pivot. The risks to the CPI downtrend are most pronounced in South Korea, India and Japan.

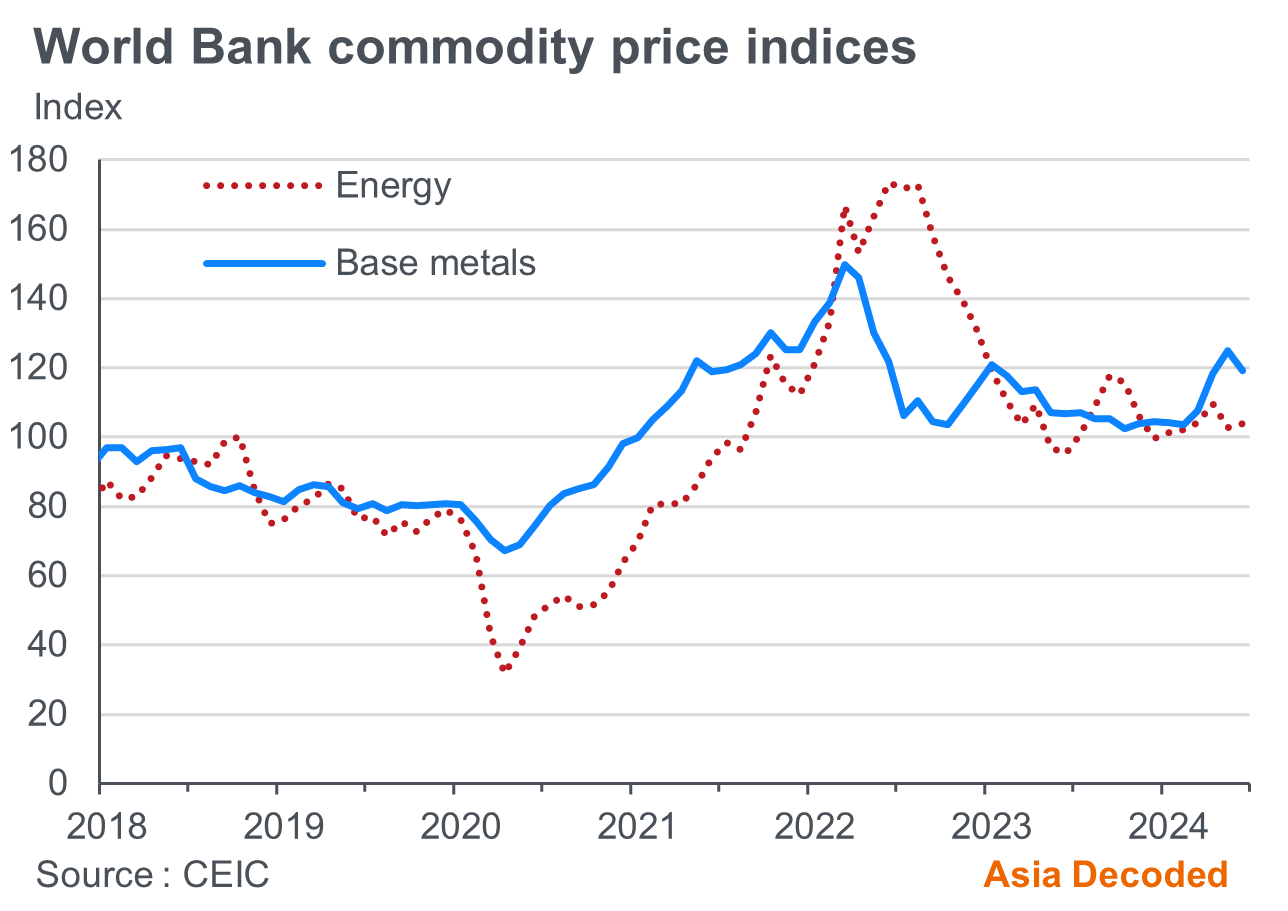

Input costs are rising again, thanks to the shallow correction in global commodity prices. Amid lingering geopolitical tensions, threats of supply chain disruptions and resilient global demand, the World Bank’s energy and base metal price indices are up by 9% and 11%, respectively, from their recent lows. This poses a risk to its forecast of 3% correction in commodity prices this year. But even if such a correction were to occur, the Bank notes…

That pace will do little to subdue inflation that remains above central bank targets in most countries. It will keep commodity prices about 38% higher than they were on average in the five years before the COVID-19 pandemic.

In Asia, excluding China, producer inflation (PPI) has climbed back to 2.7%yoy from a low of 0.2% in June 2023. Sequentially, inflation rose at the fastest pace in five months in May 2024.

Price pressures are particularly pronounced in countries with:

Higher dependence on imported raw materials and intermediate inputs, such as Thailand, Indonesia and India

Substantially weaker exchange rates, like Japan, S Korea and Taiwan

The transmission from PPI to CPI

The turn in the PPI’s trajectory adds another layer of complexity to Asia’s consumer price (CPI) disinflation, which has stalled since the beginning of the year. The direct impact of commodity prices on Asian CPIs is limited because of a gradual shift in the composition of CPI baskets towards non-tradables and services overtime. But they could still be affected by the knock-on impact of rising raw and intermediate material costs on final product prices.

To assess the likelihood of businesses passing on higher input costs to consumers, we analyse monthly PPI and CPI data for ten major Asian economies1 from January 2010 to May 2024 in a regression framework. We divide the sample into three sub-periods to observe any changes in business strategies over the years, specifically pre- and post-pandemic.

Keep reading with a 7-day free trial

Subscribe to Asia Decoded to keep reading this post and get 7 days of free access to the full post archives.