Why Indonesia should prioritize reforms over debt-fuelled growth

Overreliance on fiscal spending to boost GDP quickly can extract a heavy toll on future growth

Less fiscal space than meets the eye

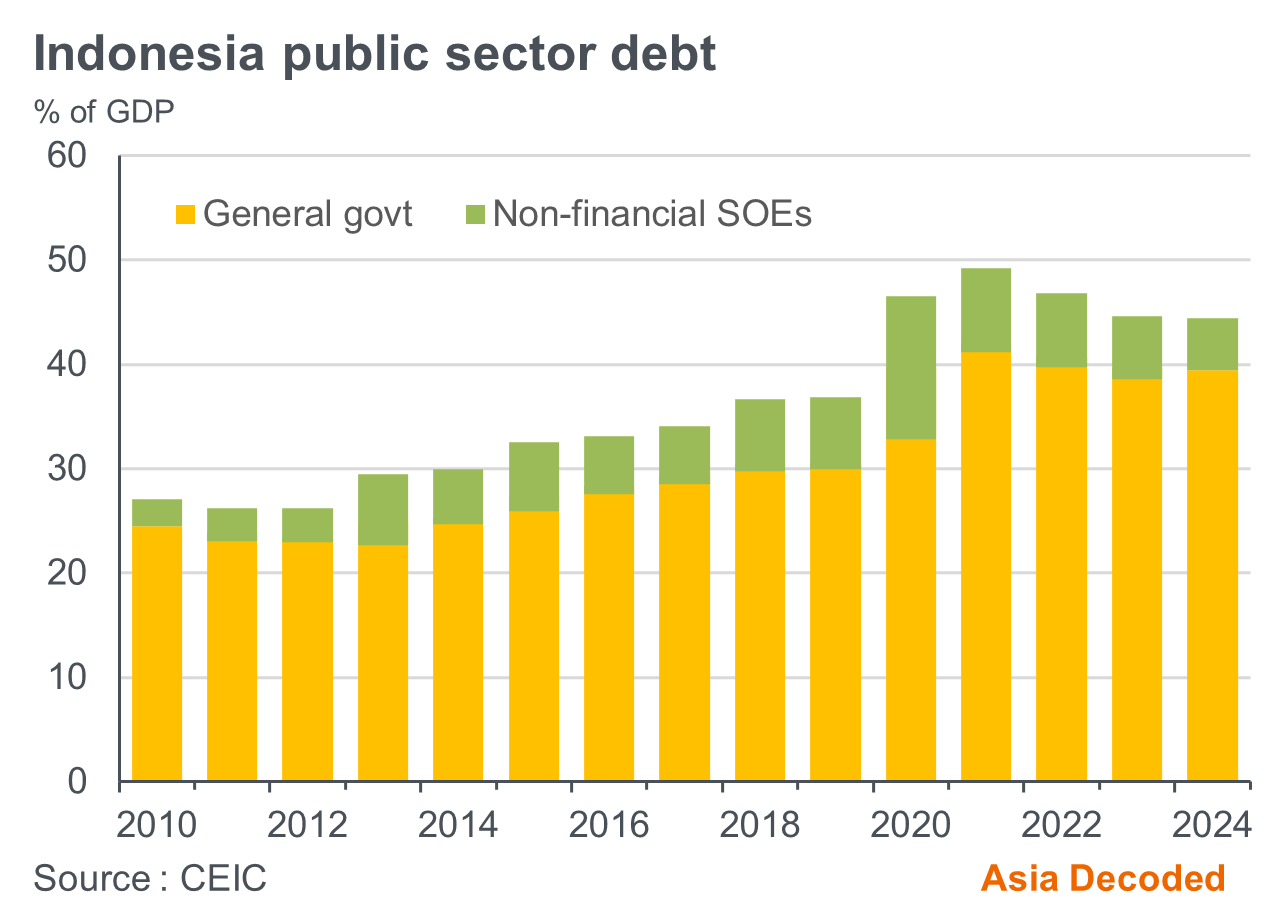

Indonesia faces many economic challenges. But one would have thought debt sustainability is not one of them. The country has long enjoyed high fiscal credibility, thanks to strict adherence to a 2003 state law that caps the deficit at 3% of GDP and the public debt ratio at 60%. Yet, a recent Bloomberg report that indicated the new government may raise the debt ratio to 50% of GDP over the next five years caused Indonesian bonds to sell-off sharply and weighed on the rupiah (IDR).

What explains this? With the post-GFC era of low interest rates behind us and primary deficits expanding in the aftermath of the pandemic, investors’ scrutiny of government finances have increased. In Indonesia’s case, fiscal risks arising from deteriorating balance sheets of state owned enterprises (SOEs), especially in the construction sector, have overshadowed the positive fiscal outturns owing to windfall commodity revenue gains.

While explicit state guarantees of SOE debt amount to less than 1% of GDP, a debt default by the country’s largest listed state builder, Waskita Karya, in 2020, has put the spotlight on fiscal risks arising from the government’s implicit support for these firms. With project delays, higher refinancing costs and a weaker rupiah weighing on the finances of overleveraged construction SOEs, in particular1, the government has stepped up capital injections into SOEs to avoid widespread defaults and stem contagion risks.

Keep reading with a 7-day free trial

Subscribe to Asia Decoded to keep reading this post and get 7 days of free access to the full post archives.